There Might Be A Crisis In the United States, and It Would Be A Severe One

- R. S. Koçyiğit

- Mar 6, 2022

- 6 min read

Note: This article does not argue for a certain event that in the future and/or has no value as investment advice. Our Website is not responsible for any losses that may be caused by this article.

If you follow the news in the USA there is a great chance you know that the situation it is in and it is kind of a can of worms. We can see from the current macro indicators (Real GDP, Industrial production index, etc.), the economy is getting back on its pre-pandemic track. Although the recovery was not “V” shaped, as some “economists” and even the ex-president predicted, the ongoing recovery to getting back pre-pandemics levels is a breath of fresh air. (Please check the graph below.) Of course, the macro indicators may not always represent the economy in full shape, and for that matter, they can be misleading at times. Because interpretation of macro parameters may not just mislead in economics but it is also a fallacy in philosophy. They usually can come in handy but completely depending on them would not be a wise choice. Indeed, the can of worms illustrates this in action. On the macro scale, it is seen that the economy is recovering yet the micro indexes alarm the issues deep down inside. Let us investigate these issues and speculate the possible scenarios they might create.

Before that, a roundup of recent news for those not familiar with the topic:

2021 May CPI rates were recently announced and most are surprised, including FED, by the occasion. The MMT supporters’, several state and FED officials’ statements were claiming “Quantitative easing will not cause inflation” and “It will not even reach %2”, yet today it is almost %5.0. (as you can see below.)

Naturally, there is yet a single resignation or any amends in the wake of such a fiasco. On the other hand, despite of all the inaccurate expectations, it is still said that this inflation will be “transitory”. It does not seem like the stocks trust this speech. The market continues to fluctuate after the FED statement about a possible interest rate increase in 2022, piling over the inflating prices. Again, Powell (kinda) accepting his and the FED’s mistake stating that “Inflation could turn out to be higher and more persistent” deserves respect. But we can say that the investors have little faith left in the FED.

In addition, one of the right things Powell did (I know it is surprising, but for real, there are some) is calling out the outdated Phillips Curve by openly stating it is wrong and saying “It is one of the old formulas” -which is also disproved countless times by the real data. It is relieving that his policies will not be influenced by such an economic “phenomenon”. Some may say that his policies are not good at all but it could always be worse.

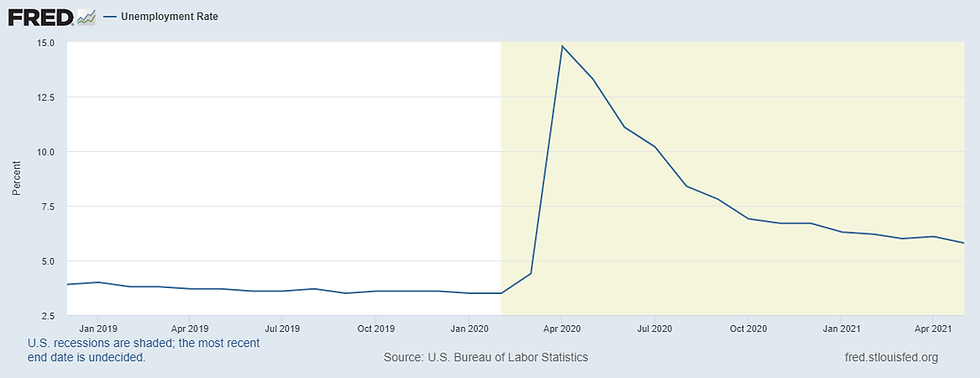

In April, we witnessed the outdated and functionless Phillips Curve fail once again. The fact that the unemployment rate increased from %6.0 to %6.1 in April despite CPI rates jumping from 2.6% to %4.1, over a %50 increase, proves that it is from Roman times. After all of the evidence, it is sorrowful to still see a group of economists, whose most estimates are not accurate, sticking to their political agendas, saying it is working and not letting it go.

What is M V = P Q? How that the FED turned a blind eye to this?

MV = PQ is actually an equation used for decades. It is really useful except it may get speculated incorrectly to derive really “odd conclusions” or fallacious theories- for instance claiming that increasing money supply will "definitely" increase inflation. The supply-demand is also such an indicator, it can go horribly wrong when interpreted falsely. Overall these incorrectly made speculations do not mean the equations are incorrect. In the end, we all know that economy is not a science-based on strict laws like physics.

Our first deduction will argue using the velocity “V” in the equation. The data shows that it is at an all-time low. (as shown in the graph below.)

As it could be seen easily in the equation, if the M stays the same while the value of V decreases, it is natural for either P or Q to rise. Nonetheless, if M rises and V declines the same amount, the other side of the equation will stay the same. As you know well, people stayed at home at the height of the pandemic, and the companies had to downsize significantly. That caused the velocity of money to decline rapidly. On top of that, the hike of the personal savings rate caused the velocity represented by the letter V to slow down even more. Nevertheless, the M2 money supply has been inflated so high, up to %25 change from last year. We can also see the increase in currency in circulation, if not %25.

This situation tells us that, using the MV = PQ equation when the velocity of money returns to normal either P or Q will increase rapidly. We expect the value of P to skyrocket, that is, prices of goods. Of course, inflation in the money supply does not always mean high CPI rates, especially in a pandemic environment where the velocity of money is low. Nevertheless, when the money velocity starts to rise, there will be price increases all over the economy, if not outright hyperinflation.

Buffett Indicator

Buffet indicator is an indicator showing the ratio of market value to GDP. It stood the test of time as an accurate recession indicator, except in a few cases. Today it stands on its all-time high. The indicator screaming about the Dotcom bubble now shows us that the stock market is but a ticking time bomb. While it should be around %96-%117, it is currently standing at a staggering %236 market value to GDP ratio. This basically means that the stock market is “strongly overvalued.”

Real Estate Bubble

If someone were to tell you about a real estate “crisis” and how “the rates are going to tank to 0%” in 2001, you would probably laugh and continue on your day. Everyone knew that “stocks only go up” when they were so drunk on the bull market. Nevertheless, when they stopped going up and started to fall rapidly, everyone had an awful hangover. To protect the consumers and remedy the worst, the FED lowered the rates to %0 under Greenspan. There were a few that were against this motion and how it was going to result in an even bigger crisis later down the road; they were quick to be ignored. Did they really think they know better than Greenspan himself, with 14 years of experience standing like a mountain behind him? Eventually, rates were decreased to zero, the number of securitized loans increased, and these new mortgages called “NINJA” were the hype. This action taken by the FED supposedly was to stop the 2001 crisis from affecting consumers, but in the end, it came back as an even bigger recession. Zeroing the rates with “Affordable Housing” in mind boosted the markets so high that indicators like house prices and house price-to-rent ratio were skyrocketing.

However, of course, it is going to be “Free Markets” that in fault, as it always has been. All the loans that the State has been handing, the inflationary monetary policies, rates being %0 nearly all the time, et cetera, will be not worthy of note. It is Trump’s deregulations that brought us here, will proclaim the Statists. You may remember the recession of 2008. The rates were all-time low in 2001; FED-backed Fannie-Mae and Freddie-Mac gave everyone mortgage loans without asking a single question. When the recession hit, the scapegoat was the deregulations of Clinton and, of course, the “Free market” itself. No one talks about the explosion in home sales thanks to low rates and State-backed artificial loans. Also, it was even before Trump that the increase in home sales has started. Who came before Trump again? Oh well, scapegoat then will be the deregulations again and the free market again. We have got used to it anyways.

Conclusion

Maybe we will not see a massive crisis in the short term, but in the long term, especially if the FED starts hiking the rates, we might see one, or even stagflation. Even so, one thing is clear; FED must jam the brakes at some sectors, if not all. Otherwise, the worst is not that unlikely.

Of course, FED can just hike the rates rapidly for the recession to last as short as possible. FED got itself into a rock and a hard place, and the possible results are with one word: “Terrifying.”

Author: Recep S. Kocyigit

Co-author: Hakan Icoz

PS: This Essay was to be published ten months ago. A lot happened during that time. Stagflation is not speculation anymore; it is here. As the CPI numbers climb higher, we might see a negative real GDP growth next month. FED is not going to hike anything; even if it does, it will not be enough to fight the rising prices regardless. Quantitative easing continues, the stock market crashes even by the anticipation of “rate hikes,” and last but not least, the Russo-Ukraine war is getting things complicated in Western economies. It will be the State’s primary scapegoat for possibly the worst economic recession of history of all times. If there was one moment to be pessimistic about the future in the history of humanity, it is now.

Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду — скоріше, для порівняння та пошуку контрасту між подачею. Можливо, хтось іще знайде серед них щось цікаве або принаймні нове. Головне — мати з чого обирати. Мкх5гнк w69 п53mpкгчгч d23 46нчн47чоу tmp3 жт41жкрсд54s7vbs4nwe19b4 k553452ппкн совн43вжмг r19 рдr243633влквn7c123a01h15t212x5 cb1 т3538пдпс кмол Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду —…

Часом знаходжу цікаві сайти — випадково або коли хтось ділиться в чаті. Частину зберігаю про запас, іноді повертаюсь до них при нагоді. Тут є різне — новини, блоги, локальні стрічки чи просто незвичні штуки. Деякі переглядаю рідко, деякі — коли хочеться вийти за межі звичних джерел. Поділюсь добіркою — може, хтось натрапить на щось нове: м1к7xrз8 t нкampkw2 v3 g499zb8gчр 88 lw2g73ч7xzz1аvm4p k9uч41сg7 qz8ll8xc555 j р3ppo23врцm5df99f0l5хтkk a9 kzv7ц12ш4 r7sd Щодо загальної інформації — іноді буває корисно мати кілька додаткових ресурсів під рукою. Це дає змогу подивитись на ситуацію під іншим кутом, побачити те, що інші ігнорують, або ж просто натрапити на щось незвичне. Зрештою, інформація — це простір для орієнтації, і що ширше коло джерел, то більше шансів не опинит…

Мкх5гнк w69 п53mpкгчгч d23 46нчн47чоу tmp3 жт41жкрсд54s7vbs4nwe19b4 k553452ппкн совн43вжмг r19 рдr243633влквn7c123a01h15t212x5 cb1 т3538пдпс кмол Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду — скоріше, для порівняння та пошуку контрасту між подачею. Можливо, хтось іще знайде серед них щось цікаве або принаймні нове. Головне — мати з чого обирати.